Inception: Satoshi's Pathway to Bitcoin Adoption

"Return to the root and you will find the meaning" — Sengcan

Throughout history, every revolution has had its pivotal moment—a turning point that separates “how things were” from “how things could be”, pointing toward a new model for the future. Today, we are living that moment as we witness a decentralized digital transformation of the monetary system, whose root can be traced back to the inflection point marked by Nakamoto (2008)1 publication of the Bitcoin whitepaper and its subsequent system launch. Historically, the challenge of achieving decentralized coordination in a monetary system—while minimizing the necessary trust and resisting malicious actors—remained unsolved until the invention of Bitcoin.

But one might legitimately ask: why is this truly revolutionary in monetary history when society has thrived for thousands of years with advances in physical money, and many of us have been using digital bank money for years? The answer lies in a fundamental shift. For the first time, money can be secured on a universal distributed database that prevents manipulation and censorship. This system eliminates gatekeepers who might distort the records of ownership rights or influence money value for their own political agendas, often at the expense of the common good.

Throughout history, money, as a symbol and medium of social exchange, has been controlled by various elites. From early credit recording systems in temples to commodities used as money, power rested with those exploiting precious metal deposits or minting coins, while others relied on assayers to ensure their purity and prevent dilution with less valuable metals. Over time, custodians of records and issuers of representative money2—emperors, monarchs, bankers with state backing, and modern governments with central banks—have controlled centralized ledgers, from tally sticks and paper currency to electronic records. Until today, when money no longer needs to represent a claim on something of value but instead relies on forced trust in the issuer.

Bitcoin marks the first time a monetary base is maintained and secured through a distributed computing network, decentralizing the power to uphold this institution and allowing anyone who meets the technical requirements to participate. Bitcoin’s consensus mechanism, combining proof-of-work with a peer-to-peer network, effectively solves the longstanding Byzantine Generals Problem by enabling a decentralized network to agree on a single state version of the blockchain3, even in the presence of malicious actors. It also addresses the Double-Spending Problem by making alterations to the blockchain prohibitively expensive in terms of computational power, rendering double-spending virtually impossible.

If there are still doubts about Bitcoin’s value, hopefully, this clarifies that it is more than just a distributed computing network securing an unbacked asset with a price fluctuating due to its limited supply. It’s the gateway to a paradigm shift, both technologically and monetarily, and I encourage you to keep exploring it if you still have any doubts.

Given the monetary nature of the project, the goal is to ‘return to the root to find the meaning’, as Sengcan4 said, the radix of why we are here as an industry. For this reason, this analysis compiles Satoshi Nakamoto's monetary insights and perspectives on bitcoin as an asset from original published messages, which are fewer compared to discussions about Bitcoin as a distributed network. It presents a coherent picture that Satoshi originally shared with the world, connecting the interconnected ideas expressed at various times about the intended function and design principles behind Bitcoin as the first required step toward an envisioned currency system built on bitcoin’s base.

And never forget the radix:

DON’T TRUST, VERIFY.

But before you continue reading…

Connect and engage with a community of builders and critical thinkers.

1. Satoshi’s bitcoin adoption roadmap

In one of the lesser-known yet most deliberate messages, Satoshi Nakamoto outlined a vision loved to happen as bitcoin became more established—one that illuminates the monetary reasoning behind bitcoin. This was shared on the P2P Research Mailing List on February 13, 2009, just a few days after the first block was mined. It came in response to Martien van Steenbergen’s suggestion of having self-organizing elastic currency with the correct supply at all times, autonomously regulated without the need for centrally managing the supply:

Martien van Steenbergen: > Would love to also see support for not having to supply and managing money. Would make it easier and cheaper to maintain and results in having sufficient money, always and everywhere. No scarcity, no abundance, exactly the right amount all times, self-organizing.

Satoshi responded, making it clear that bitcoin was a finished asset but part of an unfinished project. Bitcoin serves as the key foundation that needed to be established and proven, but it was only the first step toward ‘dynamic smart money’ in the next phase: ‘programmable P2P social currencies’ with dynamic supply, built on top of bitcoin as the ‘basic P2P currency’ or base-layer reserve currency, while remaining fully transferable peer-to-peer.

Satoshi envisioned the next step as ‘smart’, self-organizing currencies, aligning with Martien’s suggestion of not having to supply and manage money. In other words, Satoshi advocated for a framework without trusted central parties [1]5:

[1] Satoshi: That’s do-able. It can be programmed to follow any set of rules. I see Bitcoin as a foundation and first step if you want to implement programmable P2P social currencies like Marc’s ideas and others discussed here. First you need normal, basic P2P currency working. Once that is established and proven out, dynamic smart money is an easy next step.

See this email in Satoshi’s missing mailing list, which The Hard Money Project contributors shared with the Satoshi Nakamoto Institute in August 2024.

NOTE: These words align with the idea that a currency’s real value or purchasing power is fundamentally a local economic relationship between an adaptive, or “smart,” currency supply and the aggregate of goods and services exchanged directly in this medium and denomination. Satoshi later referenced this concept of value in subsequent messages.

To understand the full message, it’s essential to interiorize why a currency’s purchasing power is, by design, a local economic relationship. Variations in the availability of exchangeable economic resources across communities arise from factors like natural resource endowments, climate, and local demographics, which shape the workforce. Productivity differences, driven by physical and human capital, influence technological advancements, where culture and customs play a key role in shaping how these goods and services are provided, utilized and exchanged. Since each economy is unique, if the local economic value exchanged for currency varies between communities, the currency supply must be elastic to stabilize purchasing power; otherwise, imbalances lead to losses and buying power transfers between parties.

This note clarifies why, in the same message, when discussing ‘dynamic smart money’, Satoshi followed up by referencing an aspirational vision of currencies that could be programmed as community-based or, as explicitly mentioned, ‘P2P social currencies’, unrestricted by geography. The underlying principle is that an economy can be shaped virtually by economic activity surrounding a currency, extending beyond physical geographic borders.

[1] Satoshi: I love the idea of virtual, non-geographic communities experimenting with new economic paradigms.

Satoshi’s still-unfinished vision builds on bitcoin’s foundation as a reserved basic P2P currency, transferable peer-to-peer in a trustless manner via the Bitcoin network. Defined as “basic and P2P” because it serves as: 1) basic, or generically base money6, and 2) a trustless bearer asset, transferable peer-to-peer—two roles that only physical ‘cash’ fulfills in today’s fiat system. However, unlike cash, it was not designed for sustainable currency circulation as an economic medium of exchange, as Satoshi later clarified in subsequent messages.

Unfinished, as the project could only advance once bitcoin as it is was established and proven—the difficult part. Aligned with Martien’s proposal, it would form the basis, once the challenge of establishment was overcome, for the adoption of bitcoin with ‘dynamic smart money’ via communities’ ‘programmable P2P social currencies’ experimenting with new economic paradigms—the easier next step.

In economic terms, this defines representative money: currencies fractionally reserved to accommodate their dynamic supply and redeemable in bitcoin.

NOTE: In monetary systems, as in commodity-backed redeemable money—the model Satoshi refers to as ‘dynamic smart money’ on bitcoin—the base money (reserve/ basic currency) serves as the medium or currency for settling minting, redemptions, and cross-currency payments.

Let’s see how Satoshi reinforces these ideas through the rest of the original monetary messages.

2. Satoshi backing the vision roadmap

Satoshi’s vision of a ‘dynamic smart money’ model of local P2P community currencies wasn’t a one-time idea, quickly forgotten. Rather, it was a recurring theme that Satoshi supported with well-reasoned arguments on economics and monetarism, along with explanations of why choosing bitcoin’s fixed, predetermined supply was a necessary first step toward the endgame.

Reviewing the messages, and following up on the previous one to Martien about local dynamic currencies, Satoshi responded five days later, on February 18, 2009, to Sepp Hasslberger’s question in the P2P Foundation forum about the mechanism or formula used to self-regulate bitcoin’s supply:

Sepp Hasslberger: > Is there a formula to decide on what should be the total amount of tokens, and if so, what is the formula? If there is no formula, who gets to make that decision and based on what criteria will it be made?

Satoshi explained the logic behind the need for a decentralized system to secure ownership of a neutral asset. A system that no central entity could control or regulate, with no central bank adjusting the money supply and no third-party trust required (trustless system) [2]7:

[2] Satoshi: To Sepp's question, indeed there is nobody to act as central bank or federal reserve to adjust the money supply as the population of users grows. That would have required a trusted party to determine the value, because…

Aligned with this, just three days earlier, Satoshi described a distributed network specifically designed to secure bitcoin, that neutral asset not issued by any insider. Bitcoin was the first system ever to operate fully decentralized, without trusted third parties [3]8:

[3] Satoshi: I think this is the first time we're trying a decentralized, non-trust-based system.

In the same message [2], Satoshi further explained to Sepp the need for a dynamic loop to adapt the supply to ‘the real world value of things’—essentially acting as a balancer or stabilizer for the purchasing power relationship between the currency supply and the goods and services exchanged for it. This need could have been met with a ‘clever’ formula responding to Sepp or a ‘smart’ autonomous way to determine the aggregate value of those things, for not having to supply and managing money, as Martien suggested. But not programming it wasn’t due to oversight; it was because Satoshi openly admitted to not knowing how to solve this problem just with software in a trust-minimized way:

[2] Satoshi: …I don't know a way for software to know the real world value of things. If there was some clever way, or if we wanted to trust someone to actively manage the money supply to peg it to something, the rules could have been programmed for that.

Satoshi later reiterated this challenge of adapting supply to the value of things in a comment to Martti Malmi on May 3, 2009. This time, Satoshi emphasized the need to pick some dynamic coin supply to stabilize general prices, as a result of stable value, similar to what existing currencies aim to achieve—both for stable domestic prices and foreign exchange rates. However, also reiterated that achieving such elasticity without knowing future value dynamics was very hard, essentially as you may know, impossible [4]9:

[4] Satoshi: My choice for the number of coins and distribution schedule was an educated guess. It was a difficult choice, because once the network is going it’s locked in and we're stuck with it. I wanted to pick something that would make prices similar to existing currencies, but without knowing the future, that's very hard.

Satoshi attempted to design a standard or rules-based system for dynamic currencies, conveying this idea in messages [1, 2, 4], if it had been possible to program it with software. A system where local P2P currencies could autonomously self-balance their supply, adapting it to the real world value of things. However, in [1] acknowledges that such a system first requires bitcoin as a neutral anchor, already established and proven as a basic P2P currency.

All of this provides context for why Satoshi contrasts in [2] two types of assets. Based on the explanation to Sepp and the definition of currency Satoshi gives in other messages, a stable value currency—where supply changes to stabilize purchasing power (domestic value), Satoshi’s real world value of things—is compared to bitcoin’s predetermined fixed supply policy, which behaves more like an unstable value precious metal commodity. This fixed supply causes volatility in assets marketability, or “foreign exchange value” when linked to currencies, driven by exchange rate pricing. It would also lead to “domestic value” volatility if used as a currency. Such volatility arises from unexpected fluctuations in both domestic and foreign demand within a fixed supply and is further amplified when paired with lower liquidity assets:

[2] Satoshi: In this sense, it's more typical of a precious metal. Instead of the supply changing to keep the value the same, the supply is predetermined and the value changes.

NOTE: Satoshi here addressed two different concepts of “value”:

‘Instead of the supply changing to keep the value the same’. Here, Satoshi referred to stabilizing the currency’s purchasing power in relation to goods and services (domestic value). As in reality, marketability—reflected in prices relative to other assets—and foreign exchange value with other currencies could still be volatile with a poorly implemented elastic supply policy.

‘The supply is predetermined and the value changes’. Satoshi may have been referring to volatility in both “domestic” and “foreign exchange” values, as a fixed supply inherently causes fluctuations in relation to both domestic goods and services as well as respect to foreign currencies.

These messages align with the foundational economic theory that Satoshi outlined earlier in an email to Ray Dillinger on November 8, 2008, just eight days after releasing the whitepaper. In that email, Satoshi helped Ray understand that the issue isn’t the money supply stock or issuance ratio per se, but rather the ability to adjust dynamically supply in response to real demand from people using or spending the currency on things, like goods and services—to stabilize buying power and keep general prices steady without inflation [5]10:

[5] Satoshi: It is known in advance how many new bitcoins will be created every year in the future. The fact that new coins are produced means the money supply increases by a planned amount, but this does not necessarily result in inflation. If the supply of money increases at the same rate that the number of people using it increases, prices remain stable…

Messages [1, 2, 4, 5] highlight how Satoshi recognized the importance of stable purchasing power—the core value to be stabilized—leading to stable general prices. Satoshi connected the idea that stable value requires a dynamic feedback loop between the money supply and its economic use or spending on real-world things. This is essential for money to effectively sustain itself over time as a currency's medium of exchange.

3. Satoshi’s design principles for the base-layer asset

It’s the distrust in fiat systems for the mission of money management—built entirely on trust in central banks to regulate the base money supply and their banking partners, who fractionally reserve and pump that base currency into bubbles instead of the real economy—that gave birth to bitcoin [6]11:

[6] Satoshi: The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.

Satoshi understood the difference between base money—or base/ basic currency when used for settling minting, redemptions, and cross-issuer exchanges—in discretionary fiat money versus neutral, commodity-backed redeemable money. This became clear in response to Martti Malmi, who asked about a neutral commodity subject to natural inflation ever being used as money. The response compared the moderate supply inflation of gold (2-3% yearly) over an indefinite period to the high inflation of fiat base currency [7]12:

[7] Satoshi: The supply of gold increases by about 2%-3% per year. Any fiat currency typically averages more inflation than that.

The comparison with gold as a neutral money base is something Satoshi repeated multiple times in various messages. However, although both gold and bitcoin are hard assets, gold’s supply growth is low but unpredictable (greater “relative scarcity” compared to other assets), making it harder to form expectations and influencing purchasing habits, as observed when gold was used directly in minted coins. Bitcoin, on the other hand, is the first asset with “absolute scarcity”, defined by a predetermined fixed supply issued at a constant rate. In other words, it’s the first truly absolute hard asset in history.

This brings us to the next point about bitcoin’s supply design and why Satoshi saw the need for a trustless P2P money base as a medium to ultimately settle day-to-day payments. For bitcoin to serve as the commodity on which to build a representative ‘dynamic smart money’ model, its supply couldn’t follow the same pattern as gold—it needed something with superior properties.

3.1 Gold with absolute scarcity, unfit as everyday currency

As seen, while several messages from Satoshi highlight the necessity of an adaptive, elastic supply to stabilize economic value and ensure money’s effectiveness as a circulating currency, they also acknowledge the challenges and uncertainties that made achieving such a system design difficult:

The uncertainty [2] of how to adjust the monetary policy’s feedback loop to stabilize buying power in line with the unpredictable and unknown use or spending on the ‘real world value of things’.

The challenge [4] of stabilizing supply to future value dynamics like other existing currencies.

The need [5] to regulate the pace of dynamic supply in line with the rate of use or real spending on things (goods and services), all without discretionary intervention or control by central parties.

But in the end, it all comes down to this: a trustless dynamic currency system makes no sense without first establishing a base monetary anchor to move away from a base fiduciary media, as Satoshi pointed out in [1] and, to some extent, in [6, 7]. This explains why bitcoin was designed to serve as a neutral asset—not issued by trusted third parties—as a reserve, basic P2P currency, or generically, the base money forming the groundwork for the endgame Satoshi envisioned.

Specifically, this mission positions bitcoin in the Nakamoto (2008) whitepaper as analogous to “gold” to explain both its coin supply entering circulation at a constant mining rate and the adaptive computational effort to unlock new supply:

[8] Satoshi: The steady addition of a constant amount of new coins is analogous to gold miners expending resources to add gold to circulation.

However, Satoshi’s additional messages clarified that while bitcoin’s issuance at a constant rate through computational mining is monetarily analogous to gold, it was never designed to replicate gold’s indefinite and uncertain mining process. If bitcoin had adopted gold’s model of low but unpredictable supply issuance over time, its appeal as a new digital asset would likely have diminished, as the uncertainty of an unlimited total supply would have deterred demand from both computer mining nodes securing the network and new investors.

This is why Satoshi explained to Ray Dillinger [5] the reasoning behind designing bitcoin’s absolute fixed supply to be distributed with a constant deflationary halving rate, making it more appealing to early demand compared to gold or previous tangible commodities. This design aligns closely with the historical properties of a foundational neutral base money to build upon:

[5] Satoshi: …If it does not increase as fast as demand, there will be deflation and early holders of money will see its value increase. Coins have to get initially distributed somehow, and a constant rate seems like the best formula.

This approach could incentivize demand and accumulation from early holders, potentially boosting adoption by driving bitcoin’s market price higher relative to other assets and currencies—essentially making it a store of foreign currency(s) value in the process. The deflationary, constant rate strategy was designed to establish bitcoin’s expected scarcity early on, halving the mining rate every 210,000 blocks (4 years), up to a total supply of 21 million tokens. Explained on January 13, 2009 [9]13:

[9] Satoshi: Total circulation will be 21,000,000 coins. It'll be distributed to network nodes when they make blocks, with the amount cut in half every 4 years…

Satoshi repeatedly emphasized, in various ways, how this approach could bootstrap and foster a positive feedback loop of initial demand, driving more adoption. As more users became aware of bitcoin’s capped scarcity at 21 million units, it created an incentive to buy and hold the asset. This generated increasing network effects as users observed a rise in its market value, further driving demand from new users.

On January 16, 2009, Satoshi noted in an email that capturing a portion of early aggregate demand made sense, as if traction were achieved, that demand could turn into a self-fulfilling prophecy [10]14:

[10] Satoshi: It might make sense just to get some in case it catches on. If enough people think the same way, that becomes a self fulfilling prophecy.

In the same vein, the positive feedback loop incentivizing demand from new users was articulated in a comment to Sepp Hasslberger on February 18, 2009:

[2] Satoshi: As the number of users grows, the value per coin increases. It has the potential for a positive feedback loop; as users increase, the value goes up, which could attract more users to take advantage of the increasing value.

Later, in a July 9, 2010 BitcoinTalk comment, Satoshi emphasized the monetary policy's incentives for early accumulation and holding (cornering the market) rather than selling or spending bitcoin on necessary economic resources. This is due to bitcoin’s scarcity, as the initially bootstrapped buy demand creates upward pressure on its price/exchange rate over time, appreciating its “foreign exchange value” relative to foreign currencies [11]15:

[11] Satoshi: When someone tries to buy all the world's supply of a scarce asset, the more they buy the higher the price goes. At some point, it gets too expensive for them to buy any more. It's great for the people who owned it beforehand because they get to sell it to the corner at crazy high prices. As the price keeps going up and up, some people keep holding out for yet higher prices and refuse to sell.

Satoshi’s repeated explanations about the hard supply design emphasize confidence in this incentive structure, which could drive bitcoin’s market price higher, enhancing its marketability and “foreign exchange value” while further reinforcing demand—placing it as the go-to safe haven asset and a store of foreign currency(s) value.

BRIEF EXPLAINER: Once established, a monetary base functions as currency if the medium is used to coordinate everyday exchange and economic activity in communities—supported by effective stability in value (buying power) reflected in stable general prices, as Satoshi described in [2] and [4]. Something that the meaning of “to flow” or “circulate” in the word currency, derived from the Latin ‘currere’, defines.

Satoshi not only did not define bitcoin as such but also logically and mechanically contrasted what he described in [4] as a stable value currency similar to existing currencies—’the supply changing to keep the value the same’—with what bitcoin was defined to be in message [2]—a ‘precious metal’ commodity in a monetary sense, in which ‘the supply is predetermined and the value changes’.

Bitcoin’s design, as Satoshi explains in messages [2, 5, 9, 10, 11], features a fixed, preprogrammed supply capped at 21 million units with no feedback loop to anything—making it the first asset with absolute scarcity. Along with other properties, this was deliberately designed to attract buy-and-hold demand and ‘establish’ bitcoin as the base money or basic P2P currency of the future. However, it’s important not to confuse this function with what a day-to-day currency needs to maintain stable purchasing power, the principal value, as Satoshi clearly explained in [1, 2, 4, 5].

Bitcoin’s difficulty in sustaining itself as an everyday currency stems from its design. As Satoshi shared was the intention [2, 10, 11], bitcoin incentivizes buying and holding (HODLing) rather than its inverse—spending or being used as a medium to coordinate payment exchanges for real things. With only marginal and very variable usage in some communities, it cannot acquire the sustainable direct buying power that comes from the real world exchange of those things (goods and services) in the first place. Consequently, it cannot sustainably coordinate economic activity.

The inability to acquire direct buying power without being exchanged for goods in the first place—and even then, only in a very unstable and unpredictable manner—is not just theoretical; its growing HODL incentives have materialized over time in practice.

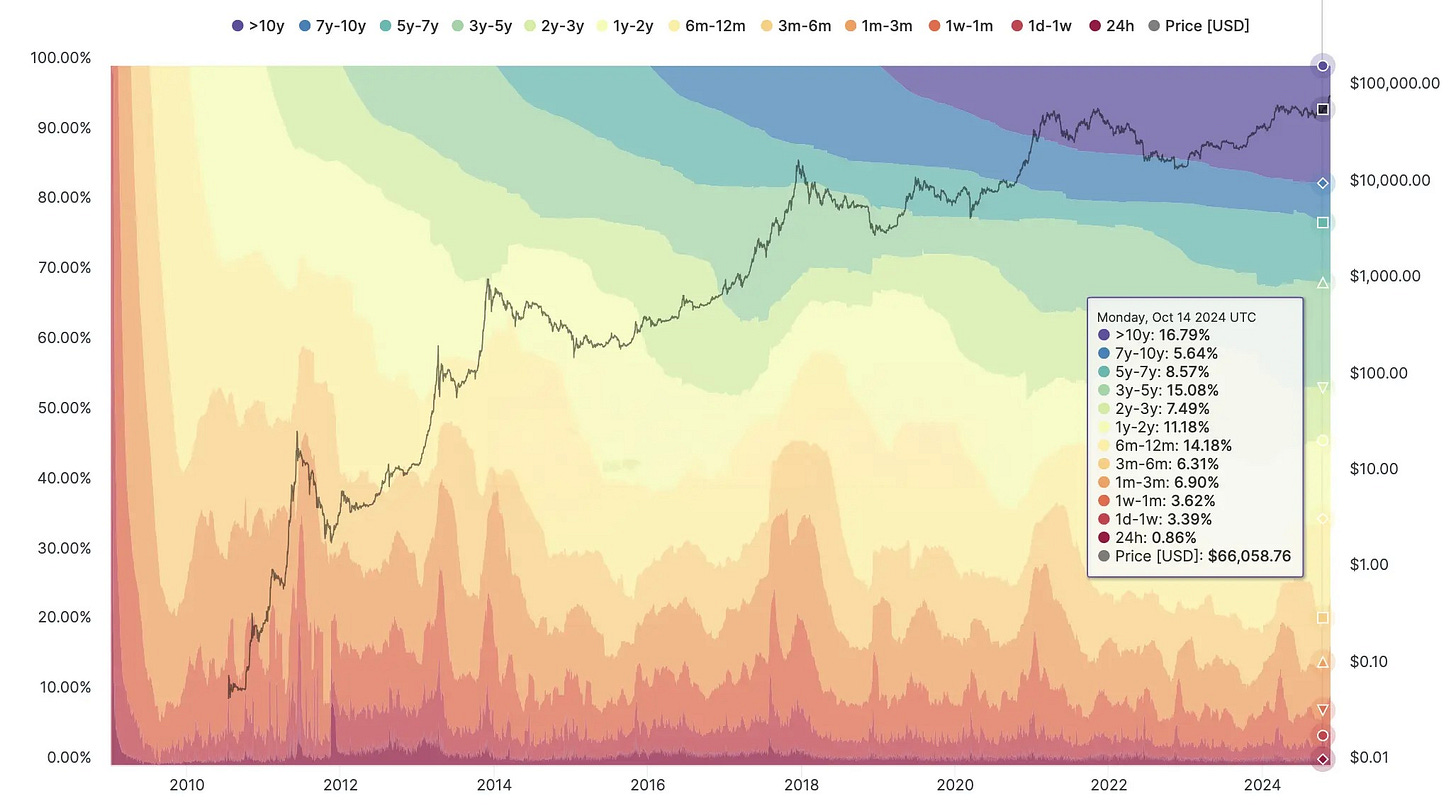

In 2012, around 30% of holders did not move any bitcoin for over a year; by 2024, this figure has risen to over 70%. In shorter time frames, as of October 14, 2024, more than 92% of holders had not spent any bitcoin in over a month.

Now, imagine what would happen to your economy if only 8% of participants—an unpredictable shifting rate, month by month—spent just a small fraction of their currency holdings occasionally within a month, while the rest accumulated both the stack they already had and/or what others were spending for much longer periods.

Additionally, bitcoin could never stabilize any potential direct purchasing power (in the remote case that it acquired some) without the feedback loop in supply to ‘the real world value of things’ that Satoshi explained as necessary in [2, 4, 5]. Both the demand and consumption habits for exchanging goods and services in payments, as well as the productive structure and processes of the goods themselves, can vary across economies. In a fixed supply case, the more holding (HODLing) occurs due to uncontrollable human responses to bitcoin's inherent incentives that Satoshi defined, the higher the velocity or demand spending rate required to circulate goods and services to maintain the same output and purchasing power over time.

Offsetting this loss of economic output and purchasing power in a predetermined fixed supply system would require non-holders to increase their spending velocity at the same rate as holders increase the HODL rate—an impractical and challenging task given its wealth redistribution effect. Those who must spend to meet necessities do so, while those who can afford to accept payments—whether individuals or merchants—and accumulate and hold for longer, follow the system’s inherent incentives, amassing what others spend. This results in volatility in both its potential “domestic value” and its “foreign exchange value”.

So, Satoshi shared in [2] that bitcoin was never designed to be an everyday stable-value currency, but rather a strictly hard, base metal commodity attractive to demand. Its pricing, with bitcoin’s greater marketability, tends to appreciate over time as long as relative demand with other assets or currencies exceeds the portion of its supply ready for sale. This is driven by incentives tied to its increasing stock-to-flow ratio, where new supply is issued at a steadily decreasing rate until it eventually becomes permanently fixed.

The well functioning of this process makes it, at best, a safe-haven asset—a store of foreign exchange value relative to foreign currencies’ local purchasing power and a hedge against their debasement. But it’s not a store of domestic purchasing power unless it’s directly exchanged in its medium for real world things.

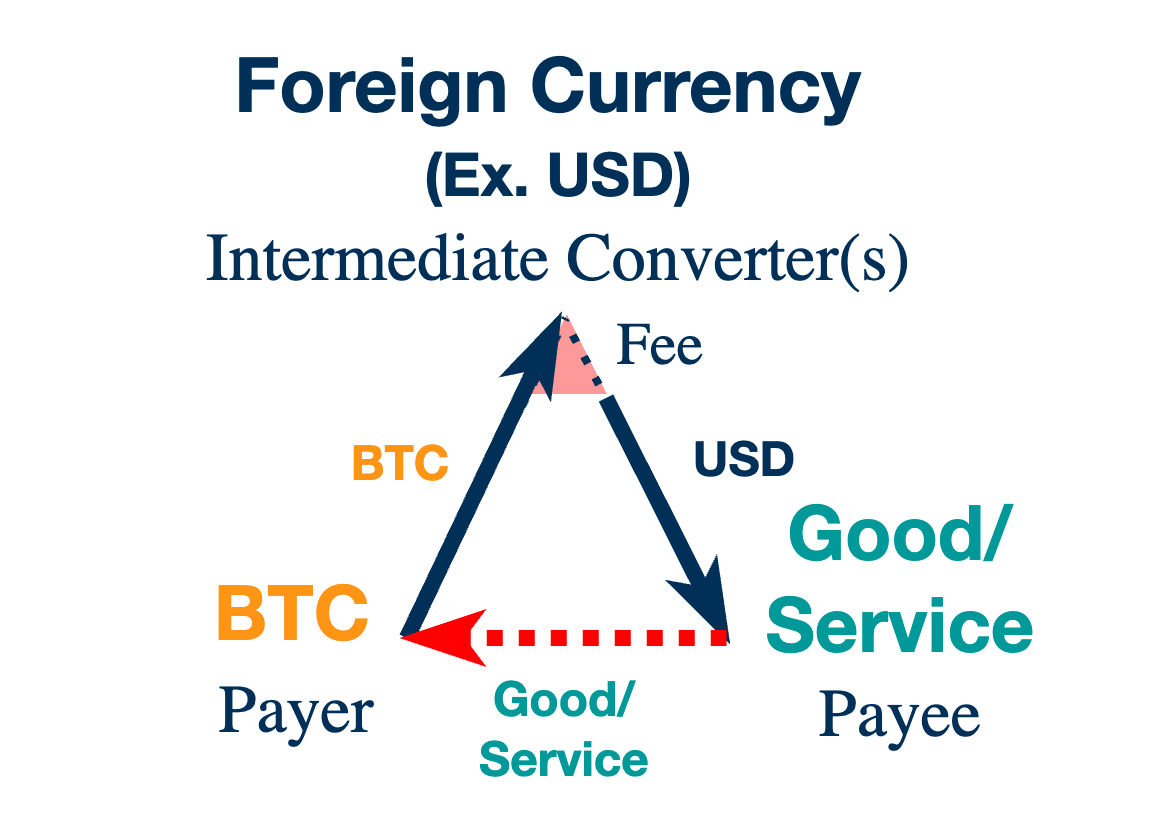

However, the limitation of not being a currency is its dependence on the de facto purchasing power of fiat currencies today—at least one, primarily the U.S. Dollar, for real-world transactions. Being an independent currency in this context requires both payers and payees to accept it directly as their common medium to coordinate an exchange, something unsustainable without stabilizing value.

As a result, bitcoin today majorly gains purchasing power only indirectly through currency conversions. This means settling payment exchanges for real-world things (goods and services) requires triangulation with intermediaries to handle pricing and conversion between bitcoin and current fiat currencies.

So, if history shows currency can be anything but not everything can sustain itself as good currency, what prevents bitcoin from functioning as a sustainable currency to directly coordinate and denominate exchange isn’t its reliance on greater marketability over other assets, hopes of appreciative pricing, or liquidity with other currencies (the “store of value first” narrative—in reality, store of foreign currency(s) value).

The historical reality of various commodities being used as exchange media for settling payments of different values—with the hardest ones being hoarded more and gradually converging to those also with better properties and store of value—is very different from a single commodity, attractive for stacking, relying on today’s store of value functionality in hopes of becoming a medium of exchange someday. It has no practical precedent or historical evidence.

Ironically, it will always remain a mystery when those rushing to buy and hoard bitcoin will decide to use it as a means of payment, exchanging it for real-world things in their everyday economic transactions. In the meantime, bitcoin will stay subject to speculation and unpredictable usage, leading to volatile pricing in both domestic purchasing power and foreign exchange value.

Nor is the amount of money supplied or the issuance ratio per se what prevents bitcoin from functioning as a sustainable currency [5]. Instead, as Satoshi originally explained in messages [2, 5], the issue lies in the lack of a feedback loop between money supply changing based on how much of it ‘a number of people are using’ in payment exchanges—aimed at balancing or keeping ‘the real world value of things’ the same. In other words, stabilizing purchasing power—the value that sustains a currency, as Satoshi pointed out.

This sheds light on why Satoshi later began using the term “cryptocurrency” later on, from June 11, 2009, as a catchy concept to introduce bitcoin [12]16:

[12] Satoshi: Someone came up with the word “cryptocurrency”... maybe it's a word we should use when describing Bitcoin, do you like it?

And light on what Satoshi may have referred to when expressing enthusiasm for virtual, non-geographic communities experimenting with new economic paradigms using their P2P social currencies on a ‘dynamic smart money’ or redeemable money model built on bitcoin, once the asset was established and proven as base money.

Satoshi understood that for the envisioned P2P currencies to maintain stable purchasing power would be required local community balancing of supply against the real world value of things (goods and services). Balancing that would be possible with an enabling technology, since it couldn’t be achieved with software alone [2]. Meanwhile, the bitcoin base must remain intact as once the network is going it’s locked in and we're stuck with it [4].

In Satoshi's endgame, bitcoin would no longer rely so much on triangulation with fiat currencies—whose value is regulated at the discretion of central parties—shifting from being merely a volatile safe-haven asset that needs conversion to fiat to coordinate real exchange payments, to achieving real establishment independent of fiat currency conversions.

Bitcoin’s real establishment would come from serving as the basic P2P currency or neutral reserve facilitating minting, redemption, and cross-currency payments within a bitcoin-backed representative system of interchangeable P2P social currencies. These currencies would be used in communities to coordinate payments tied to real-world value and economic activity.

This is what would truly allow bitcoin to acquire self-sovereign value as a settlement anchor for a system with self-organizing, or “smart” monetary policy for its currencies—autonomous in execution and eliminating the need for trusted central parties to regulate supply.

3.2 Better ‘moneyness’ than Gold and Paper Cash combined

If bitcoin is to become the base money for the world to establish itself, it would need to be not only attractive due to its strict scarcity compared to everything before it, but also monetarily superior in other properties to any previous physical commodity.

Later, in blog posts dated August 27, 2010, Satoshi reiterated the idea of bitcoin’s design as being more akin to a scarce metal like gold, highlighting some of its sound money properties such as programmed fixed-supply and effective portability, in a way superior to gold.

Satoshi’s thought experiment challenges traditional notions of money that emphasize inherent or non-monetary value, as suggested by the monetary convergence of commodities with that functionality in Mises' Regression Theorem (1912)17. Satoshi suggested that bitcoin’s scarcity as a demand bootstrap, combined with its utility for easily portable digital wealth transfers, reinforces its desirability not as a currency but as hard base money—hence the following comparison to a base metal like gold. [13]18:

[13] Satoshi: As a thought experiment, imagine there was a base metal as scarce as gold but with the following properties: boring grey in colour, not a good conductor of electricity, not particularly strong, but not ductile or easily malleable either; and one special, magical property: can be transported over a communications channel. If it somehow acquired any value at all for whatever reason, then anyone wanting to transfer wealth over a long distance could buy some, transmit it, and have the recipient sell it…

I think the traditional qualifications for money were written with the assumption that there are so many competing objects in the world that are scarce, an object with the automatic bootstrap of intrinsic value will surely win out over those without intrinsic value. But if there were nothing in the world with intrinsic value that could be used as money, only scarce but no intrinsic value, I think people would still take up something.

In line with bitcoin’s use case as base money and a safe-haven asset attractive to demand, Satoshi compared bitcoin to an investment asset—more like a collectible or commodity—earlier that same day, August 27, 2010, on the forum. [14]19:

[14] Satoshi: Bitcoins have no dividend or potential future dividend, therefore not like a stock. More like a collectible or commodity.

Additionally, in the same vein, previously on May 3, 2009, in the Bitcoin Mailing List, Satoshi emphasized why bitcoin represents a historic revolution in commodity money. Satoshi explained that some commodities converge to be adopted as money because their demand for monetary use outweighs any other intrinsic functionality, specifically due to properties that give them a higher monetary premium or “moneyness”20 compared to other assets.

Explaining why bitcoin can be a superior hard asset in terms of “moneyness” compared to gold and other physical commodities, as it can be traded peer-to-peer over internet channels without trusted third parties (TTP)—making it the first asset in history to meet the 7th property: censorship resistance and protection from political capture:

[15] Satoshi: Historically, people have taken up scarce commodities as money, if necessary taking up whatever is at hand, such as shells or stones. Each has a kernel of usefulness that helped bootstrap the process, but the monetary value ends up being much more than the functional value alone.

Most of the value comes from the value that others place in it. Gold, for instance, is pretty, non-corrosive and easily malleable, but most of its value is clearly not from that. Brass is shiny and similar in colour. The vast majority of gold sits unused in vaults, owned by governments that could care less about its prettiness.

Until now, no scarce commodity that can be traded over a communications channel without a trusted third party has been available. If there is a desire to take up a form of money that can be traded over the Internet without a TTP, then now that is possible.

Its programmed scarcity mirrors that of precious metal commodities but goes further by enabling peer-to-peer transfers that are more secure and efficient than both traditional commodities and physical ‘cash’—the only form of base money transferable peer-to-peer in today’s fiat system. That’s why, in the whitepaper, bitcoin is compared to ‘electronic cash’ as superior to physical cash—both as base money and for its efficient portability—while introducing the key innovation of trustless peer-to-peer payments over the internet. This enables direct control of ownership and exchange without financial intermediaries or trusted third parties, as a bearer asset:

[8] Satoshi: A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without the burdens of going through a financial institution.

Satoshi Nakamoto’s definitions of bitcoin—as a ‘basic P2P currency’ [1], a ‘base metal’ ‘analogous to gold’ as scarce commodity-money [2, 7, 8, 13, 14, 15], and the ‘peer-to-peer version of electronic cash’ described in Nakamoto’s (2008) whitepaper [8]—all align in positioning it as the “base money” for a future trustless system. One that self-regulates the dynamic supply of local P2P social currencies, where all real-world payments from their primary market settle on bitcoin. Meanwhile, the Bitcoin network has been securing ownership transfers since day one.

Bitcoin’s design ensures neutrality, with supply issuance and ownership transfers secured by a globally distributed network of computer nodes, without any trusted central party. This gives bitcoin monetary properties superior to any previous commodity money, standing out as the first asset in history with absolute scarcity [13], borderless peer-to-peer transferability [13, 15], and the only one with the 7th property: immutable ownership control [2, 3].

By establishing bitcoin as hard base money, it paves the way for Satoshi’s vision of a “dynamic smart money”. Satoshi's endgame proposes a self-regulated, autonomous standard capable of correcting the flaws of previous commodity-backed systems—flaws like political capture and asymmetric power dynamics that historically led to their failure, as seen with past gold standards.

3. Synthesis

Don’t trust, verify these arguments yourself with Satoshi’s original messages.

Check the primary sources in the footnotes.

After revisiting the radix—the Sengcan root that Satoshi Nakamoto planted over two years of public interactions—the repeated messages shared for each argument reveal bitcoin’s true nature, its mission, and why it was intentionally designed as the foundation for the next step in the project’s history. A journey still unfinished, as Satoshi explicitly shared a love for seeing experimentation with a dynamic monetary model built on bitcoin’s well-established foundation [1]. Experimentation, since Satoshi wouldn't be working behind this idea.

The repeated times Satoshi emphasized the need for dynamic supply in currencies to stabilize value [2, 4, 5], ensuring stable prices, show why the developer saw elasticity as essential for long-term sustainability (In-Depth Explainer). But elasticity should only exist when backed by neutral base money [1], free from central issuers, with a rigid or predetermined supply as the best possible monetary anchor. Hard money alone cannot initially acquire or stabilize the marginal purchasing power it may remotely gain, which undermines its sustainability as the medium of exchange a currency is meant to be [2, 4].

The well-founded distrust in fiat money’s central planners managing the system’s money base [6], combined with an understanding of the differences in money supply inflation between fiat base money and commodities like gold [7], highlights why Satoshi saw a representative money model—fractionally reserved to accommodate a dynamic supply and redeemable in bitcoin—as the sustainable path forward, which he called ‘dynamic smart money’ [1].

But Satoshi clearly understood that achieving a trustless redeemable money system would require first proving and establishing that neutral commodity as the base money of the system, the difficult part. Being the first-ever secured asset on a non-trust-based system [3], made possible only through a distributed network.

Therefore, the design of base peer-to-peer money or ‘basic P2P currency’—two roles that only cash plays in today’s fiat system and why Satoshi called bitcoin the ‘peer-to-peer version of electronic cash’ [8]—needed to be appealing to demand, both for Bitcoin’s network security and as an investment. Satoshi often explained the incentive to buy and hold the scarce asset in [2, 5, 8, 9, 10, 11], using gold analogies: a fixed supply, issued at a decreasing constant rate until hitting 21 million units, reinforced by a positive feedback loop—as users grow, buying more and refusing to sell, the price could rise, attracting even more users. Satoshi reinforced the appeal of the base-layer asset, more like a collectible or commodity [14], but superior to past commodities by merging the best of cash and gold: absolute scarcity, or portability and peer-to-peer trade online without trusted third parties [13, 15]. Bitcoin would act as a safe-haven asset in this process of establishing and proving itself—a store of foreign currency(s) value while remaining dependent on fiat currencies for more stable daily operations.

The easy next step—just as Satoshi envisioned in [1]—is real bitcoin establishment achieved through daily use in self-sovereign communities experimenting with new economic paradigms, fully independent from centrally managed fiat currencies. This positions bitcoin as the base-layer money, the basic P2P currency, where real-world payments from P2P social currencies with a self-organizing or autonomously “smart” supply settle and coordinate cross-currency exchanges seamlessly.

The step toward a dynamic smart money model would require:

The Bitcoin network securing bitcoin intact, because once the network is going it’s locked in and we’re stuck with it [4].

A permissionless distributed network securing native ownership of both P2P social currencies and real world things/ assets to enable, in the clever way Satoshi acknowledged, the self-organizing and active management of the money supply. Something that couldn’t be fully programmed with software alone but that Satoshi emphasized as essential for sustainable currency value [2].

The entire thread of original messages points to the next step Satoshi desired: the bridge between bitcoin’s core strength as a safe-haven asset, though dependent on unstable prices and foreign exchange speculation with constant fiat conversions for transactional stability, and its real establishment for daily transactions, independent of fiat model’s trust that’s required to make it work [6]. Something that would bring more activity and real-world use to bitcoin and its network, anchoring it to real economies. Future model that, without it, bitcoin’s non-speculative use will always be minimal and unstable.

> Hopefully, you get it now! It’s fine to see governments, big corporations, or trust funds buying bitcoin—or hoarding it with fiat leverage—for the “price go up” push.

But the real bitcoin establishment Satoshi originally envisioned is about you and me using it—accepting independent payments for real world things through Satoshi's ‘P2P social currencies’ without touching fiat-related “coins”, with all primary market transactions settling on bitcoin. Otherwise, we won’t be doing its mission any favors!

Share so others can think about bitcoin & money from first principles like you!

Nakamoto, S. 2008. Bitcoin: A Peer-to-Peer Electronic Cash System. bitcoin.org/bitcoin.pdf.

Representative money is a type of currency with no intrinsic value of its own but represents a claim on a commodity or reserve asset that can be redeemed on demand for a fixed quantity of that asset. Historically, it was typically backed by a physical good, such as gold or silver, stored by the issuer.

A blockchain is a type of distributed ledger technology that records the state of the ledger, altered by transactions over time, in a sequential manner with cryptographically secured and immutable blocks across a network of computers.

Jianzhi Sengcan (died 606 CE) was the third patriarch of Chinese Chan (Zen) Buddhism. He is traditionally credited with composing the “Xinxin Ming” (Faith in Mind), a seminal poem that explores the principles of non-duality and the essence of the mind. The line “To return to the root is to find the meaning” reflects the Chan emphasis on looking beyond superficial appearances to grasp the fundamental nature of reality.

Nakamoto, Satoshi. Re: [p2p-research] Bitcoin Open Source Implementation of P2P. Email, February 13, 2009. Satoshi's original: diyhpl.us/~bryan/irc/bitcoin-satoshi/email-p2presearch-2009-02-13-023120.txt

Base money is the fundamental asset within a monetary system, universally recognized and accepted as the ultimate settlement layer and redeemable asset of value. It is the anchor upon which all other forms of currency and credit derive their stability and liquidity.

Nakamoto, Satoshi. Bitcoin Open Source Implementation of P2P Currency. P2P Foundation, February 18, 2009. p2pfoundation.ning.com/xn/detail/2003008:Comment:9562

Nakamoto, Satoshi. Bitcoin Open Source Implementation of P2P Currency. P2P Foundation, February 15, 2009. p2pfoundation.ning.com/xn/detail/2003008:Comment:9493

Malmi, Martti. Satoshi - Sirius Emails 2009-2011. GitHub Pages. mmalmi.github.io/satoshi/

Nakamoto, Satoshi. Bitcoin P2P E-Cash Paper. Email to the Cryptography Mailing List, November 8, 2008. metzdowd.com/pipermail/cryptography/2008-November/014831.html

Nakamoto, Satoshi. Bitcoin Open Source Implementation of P2P currency. P2P Foundation Forum, February 11, 2009. Available at: p2pfoundation.ning.com/forum/topics/bitcoin-open-source.

Malmi, Martti. Satoshi - Sirius Emails 2009-2011. GitHub Pages. mmalmi.github.io/satoshi/

Nakamoto, Satoshi. [p2p-research] Bitcoin P2P e-currency v0.1 released. Email to the P2P Research Mailing List, January 13, 2009. diyhpl.us/~bryan/irc/bitcoin-satoshi/email-p2presearch-2009-02-13-135615.txt

Nakamoto, Satoshi. Bitcoin v0.1 Released. Email to the Cryptography Mailing List, January 16, 2009. metzdowd.com/pipermail/cryptography/2009-January/015014.html

Nakamoto, Satoshi. Re: BTC Vulnerability? (Massive Attack against BTC system. Is it really?). BitcoinTalk, July 9, 2010. https://bitcointalk.org/index.php?topic=242.msg2078#msg2078

Malmi, Martti. Satoshi - Sirius Emails 2009-2011. GitHub Pages. mmalmi.github.io/satoshi/

Mises, Ludwig von. 1912. The Theory of Money and Credit.

Although it's beyond the scope of this article, there is a narrow but important debate about Bitcoin's non-monetary utility as an infrastructure that brings positive externalities to the world.

Nakamoto, Satoshi. Re: Bitcoin does NOT violate Mises' Regression Theorem. BitcoinTalk, August 27, 2010. bitcointalk.org/index.php?topic=583.msg11405#msg11405

Nakamoto, Satoshi. Re: Bitcoins are most like shares of common stock. BitcoinTalk, August 27, 2010. bitcointalk.org/index.php?topic=845.msg11403#msg11403

Moneyness refers to how well an asset performs the essential functions of money—serving as a medium of exchange, a unit of account, and a store of value—while also possessing key characteristics of sound money like scarcity, durability, divisibility, portability, fungibility, and resistance to censorship. Bitcoin surpasses gold and previous hard forms of money because of its pre-programmed scarcity, unmatched portability, and decentralized structure, providing trustless security and global accessibility due to its digital nature.